What a Maturing Salesforce Job Market Looks Like in Mexico and LATAM

- Team Saltbox Mgmt

- Feb 9

- 2 min read

Updated: Feb 10

Not every insight from this survey was unexpected, but several of the strongest patterns did align closely with what we already see working with Salesforce professionals across Mexico and LATAM.

This post focuses on the signals that confirmed existing realities in the market.

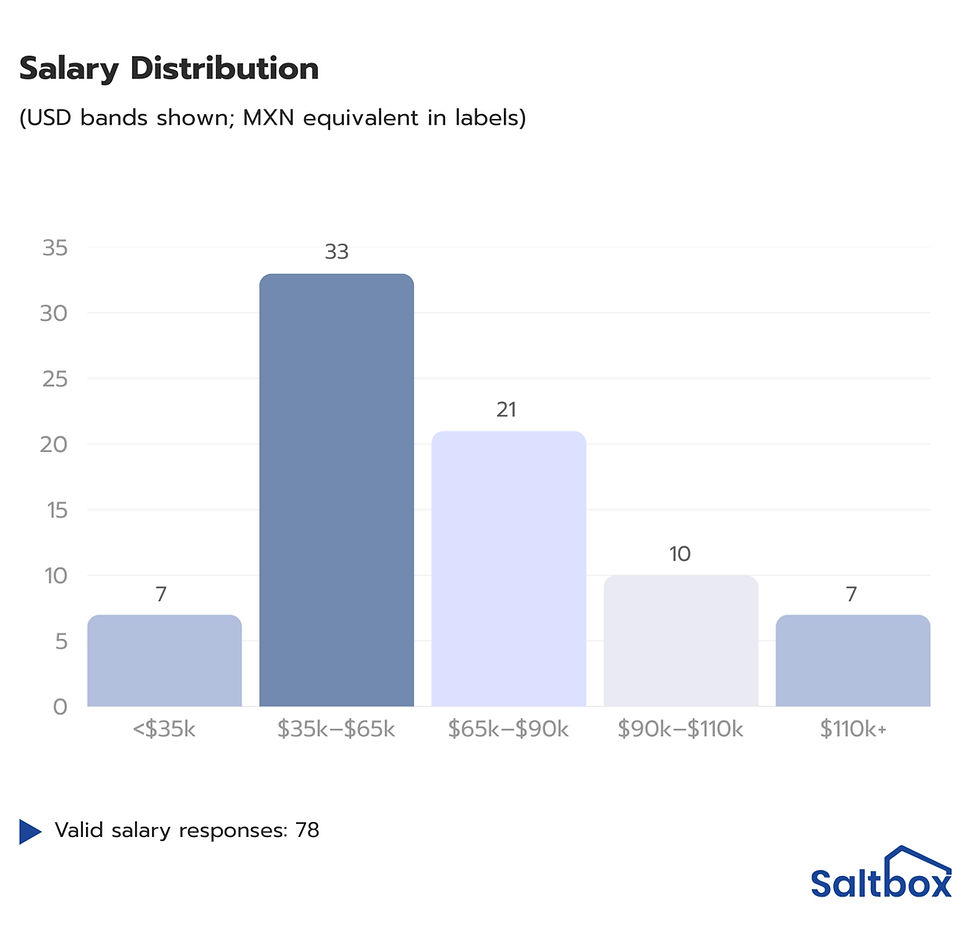

Salary is concentrated in the middle of the market

Salary data from 78 valid responses shows heavy clustering in mid-range compensation bands.

The largest group of respondents earns between $35k–$65k USD (33 respondents)

Another 21 respondents fall in the $65k–$90k USD range

Only 7 respondents reported salaries above $110k USD

This distribution confirms what many professionals already experience. The market has a strong middle, but relatively few roles at the very top or bottom. Compensation is not evenly spread. It compresses toward the center. This is a common pattern in maturing delivery ecosystems.

Remote work is now the dominant model

Work model data reinforces how Salesforce work is being delivered today.

46 respondents work fully remote

26 respondents work in hybrid roles

Only 8 respondents work fully in office

Remote-first work is no longer a differentiator for roles. It is the baseline. This shift helps explain why location alone is becoming less predictive of salary and opportunity.

The workforce skews intermediate to senior

The seniority breakdown reflects a delivery-focused, experienced population.

25 respondents identify as Intermediate

31 respondents identify as Senior

Leadership roles remain limited, with 8 respondents in manager, director, or VP-level roles

This confirms a familiar structure: a broad base of experienced practitioners supporting a much smaller layer of formal leadership. Experience matters, but advancement opportunities narrow as seniority increases.

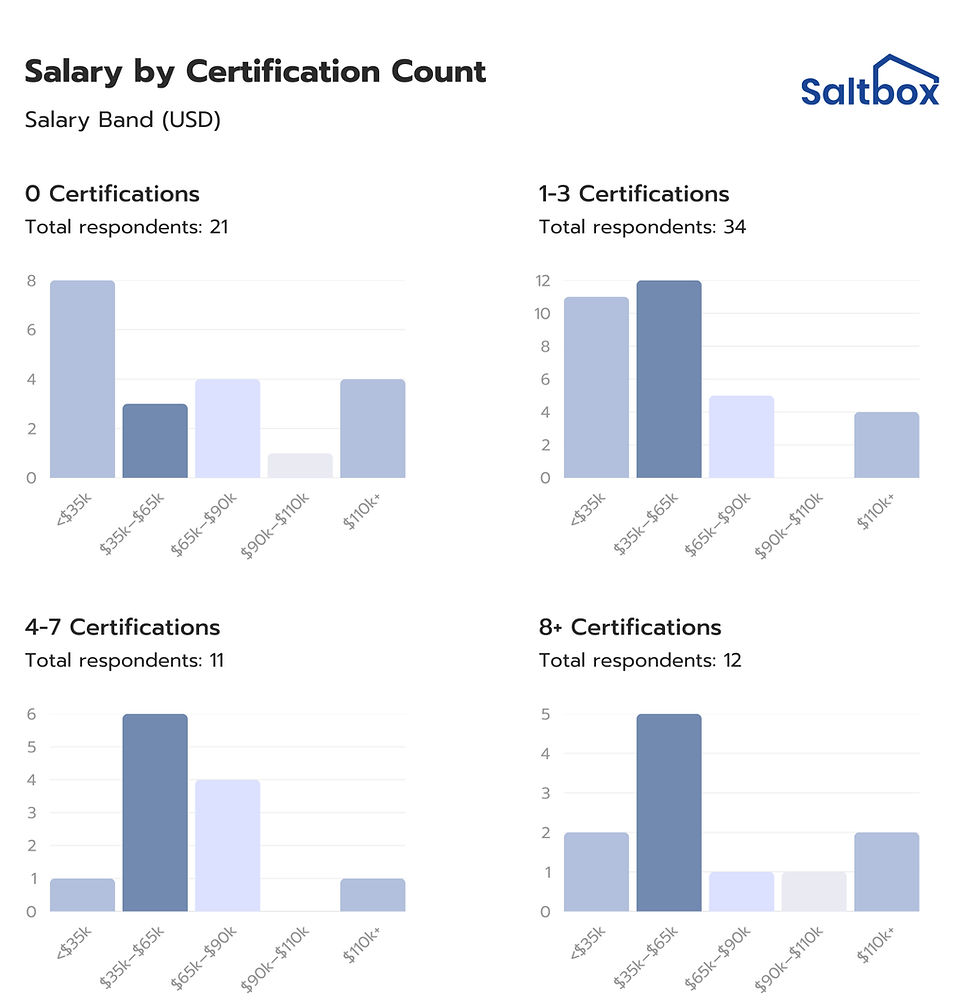

Certifications are common, but not decisive

Certification counts are spread widely across the dataset.

34 respondents hold 1–3 certifications

21 respondents report having no certifications

Smaller groups report higher certification counts

Despite this spread, certifications do not align cleanly with higher salary bands. Respondents with more certifications appear across nearly every compensation range.

This reinforces a known reality in the ecosystem: certifications are often necessary to enter or move within the market, but they are not sufficient on their own to drive compensation growth.

What this confirms

Taken together, these patterns reinforce a consistent picture.

The market has a strong, well-established middle

Remote work has flattened geographic differences

Experience matters, but progression is uneven

Certifications support careers, but do not define pay

None of this is surprising. But having it reflected clearly in data helps ground future conversations about career progression.

In the next post, we’ll focus on what did surprise us.

P.S. We’re continuing to invest in Salesforce talent across Mexico and LATAM. If you’d like to see open roles at Saltbox Mgmt, you can find them here.